Landlords take a lot of things into account when looking at potential renters, and credit score can be one of the most important factors in their decision. Running a credit check is typically an essential part of the approval process, so it is important to make sure that your credit score is as good as it can be. Credit scores are confusing and can become overwhelming, so it is essential to understand just how your score impacts your ability to rent an apartment.

What is a credit score?

A credit score is a measure that helps to provide a general indicator of how good your financial habits are. Because you can obtain your credit score from multiple different companies such as FICO and annualcreditreport.com, or credit bureaus such as Transunion, Experian and Equifax, it is likely that you could receive several unique scores. Free credit reporting is widely available. However, there are a few key factors that go into calculating your credit score.

Credit history

Your credit history is the record of how your credit has been managed in the past, from your credit lines to the timeliness of your payments.

Current unpaid debt

The amount of credit card debt will go into determining your credit score. One of the best ways to keep your score high and interest payments low is to pay each month in full as often as possible.

Age and number of credit cards and accounts

Older credit card accounts help to raise your credit score, so don’t cancel any cards you no longer use (unless they have been stolen, of course).

Past debts, foreclosures, and bankruptcies

Make sure to pay your bills and rent payments on time, as late payments will severely affect your payment history and subsequently increase the risk of a low credit score.

Avoid misunderstanding with your landlords, because evictions can, much like declaring bankruptcy, prove detrimental to your credit score.

Keeping a lower credit utilization rate

Using less of your available credit is often considered a measure of good financial habits and a sign that you are not overspending.

Avoid too many official credit checks, also known as a “hard inquiry.”

Your credit score will possibly be lowered with every official credit check requested on your behalf. Unofficial credit checks through independent companies like FICO will not affect your credit, rest assured. Almost every time you submit a credit card or rental application, a potential lender or potential landlord will request an official credit check on your behalf.

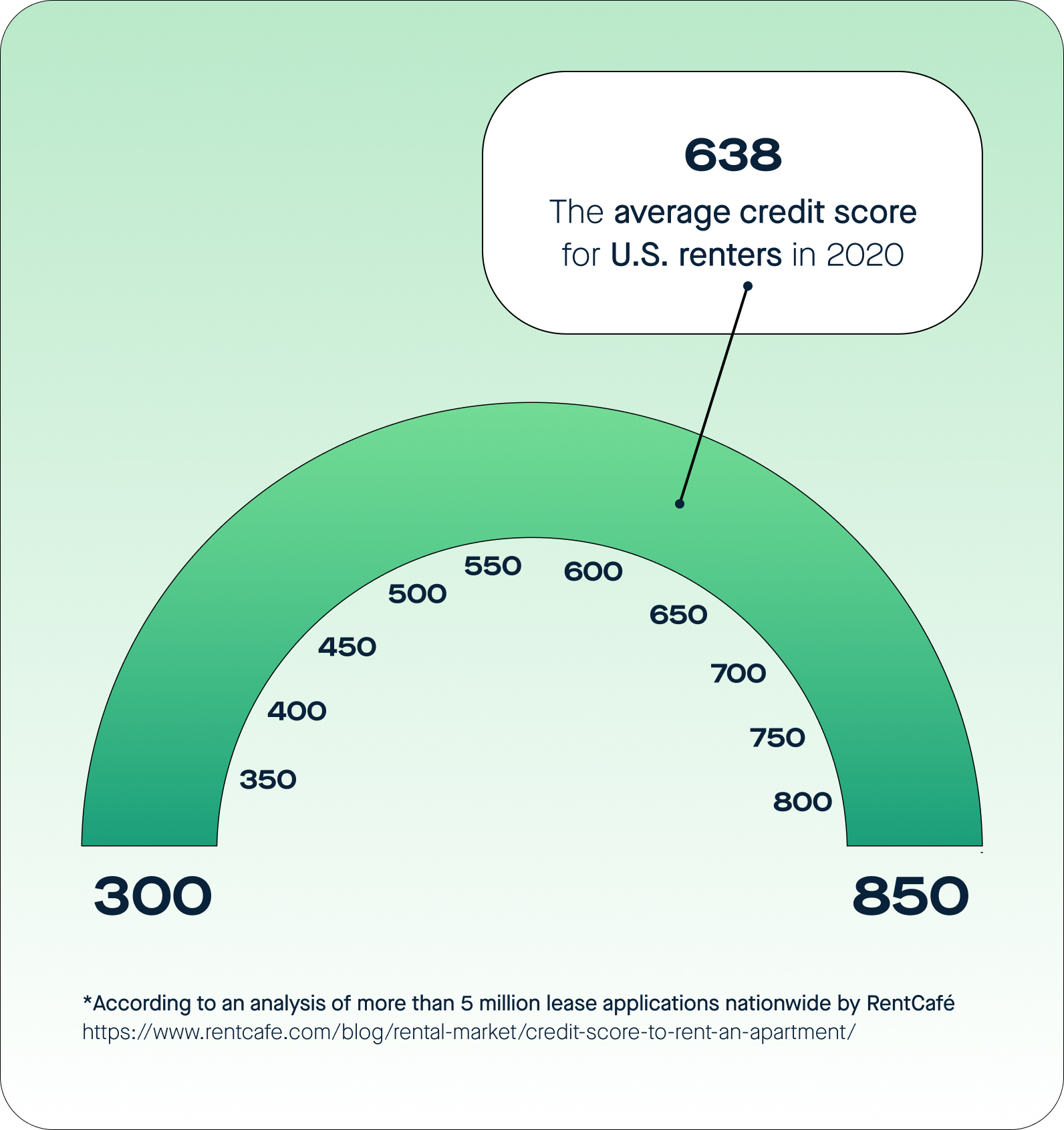

Credit scores range between 300 and 850, and the higher score you have, the better. There are many ways to quickly obtain a higher credit score, including increasing the frequency of your payments, disputing any errors you find in your credit report, and diversifying the types of credit you have.

How do I get a higher credit score?

More often than not, a good credit score takes time, and sometimes your credit history might remain unwavering for years, even with the best behavior. A credit card is often the simplest product to utilize towards credit building, although credit card lenders might require you to pay a higher interest rate than other lending opportunities. An added benefit to credit cards – many lenders offer free credit reports as an additional service, and most utilize information from legitimate credit bureaus. And credit cards inherently provide you with another bank statement if required on your rental application.

If you have minimal credit history and are having trouble getting approved for a traditional credit card, try applying for a secured credit card. A secured credit card’s maximum balance is often equal to the deposit provided upfront, but keeping a secured credit card for several years will help you attain a traditional credit card.

What score do I need?

A 2020 analysis of over 5 million renters performed by apartment-info analysis site RENTCafé found that the average credit score of U.S. renters was 638, and has been increasing yearly. Additionally, higher-end buildings attracted (or approved) renters with higher scores, while renters with scores in the 500s tended to live in lower-end buildings. But be warned, there is no universal minimum credit score requirement, and you will likely have to compare different criteria amongst landlords. Also, certain neighborhoods or especially competitive cities like New York might also require higher scores.

Landlords tend to look for scores in the 600s, and many will typically only consider renter applicants with a credit score above 650. If you fall below these marks, don’t despair — there are workarounds to bad credit that you can utilize and still be able to rent an apartment.

Guarantors and co-signers

One way to make up for a bad credit score is to use a guarantor. A guarantor is another person, who may or may not be living in the apartment with you, who agrees to be legally responsible for your rent if you miss payments. This is similar to a co-signer, who is also held liable for your rent, but does live in the same apartment as you. You can also use a guarantor service from a company.

Guarantors and co-signers provide an added layer of security for landlords that will often make them more comfortable leasing an apartment to someone with a subpar credit score. Sometimes, landlords may require a guarantor even if your credit score is at an acceptable number.

At the end of the day, a credit score is just a number; some landlords do not even look at them or include a credit check on a rental application, and a poor credit score isn’t necessarily a red flag guaranteed to tank your application. Often, a property manager will put more weight into factors like a stable income, proven through pay stubs, or a good background check, over good credit. Making sure you have a well-rounded application is more important than pouring all of your energy into raising your credit score by a few points.

If you can’t find a close friend or family member to act as your guarantor, you can use a third party service to satisfy the requirement. Rhino offers guarantor service and security deposit insurance that is affordable for renters and gives potential landlords the financial stability they need.