Sometimes life comes at us fast. An unexpected event can drain your bank account. You may have miscalculated your monthly budget. If you’re strapped for cash at the end of the month, you may wonder, “Can I pay my rent with a credit card?” As a matter of fact, yes, you can! However, there are definitely some important things to know before you make that decision.

Should I pay my rent with a credit card?

There are a few benefits to paying rent by credit card. Paying your rent with a credit card eliminates the need to use paper checks and removes the time you wait for the money to leave your bank account. You also may be able to earn airline miles, bonus points, or cash back depending on the type of rewards credit card you have. I mean, the more you can travel for free, the better!

There are also several very important factors to take into account when exploring the idea of paying rent with a credit card.

Fees & interests to keep in mind:

You might be charged a cash advance, processing fee, or might have a high annual fee. A processing fee can be anywhere from 1.99% or higher.

Keeping up with the credit card payments can be tough, and putting a large amount on the card will bring you closer to your credit limit.

Any credit card purchase can affect your overall credit score, so make sure you understand it’s impact on your ability to get another credit card, submit a rental application, or take out a mortgage.

How putting your rent on a credit card can impact your credit score

When it comes to paying your rent with a credit card your credit score can be affected. That’s because your credit utilization ratio (the total amount of debt that you have vs the amount of available credit you have) will change. That ratio is a key factor in calculating your credit score so don’t be surprised if it goes down. For more information on how to calculate your credit utilization ratio, click here. (And while you’re at it, check your FICO credit score or request a full credit report.)

Ok, so you’ve weighed the pros and cons of putting your rent on your Mastercard, Visa, Discover, or American Express, deciding to take advantage of your good credit, but how exactly would you go about making your rent payment with plastic?

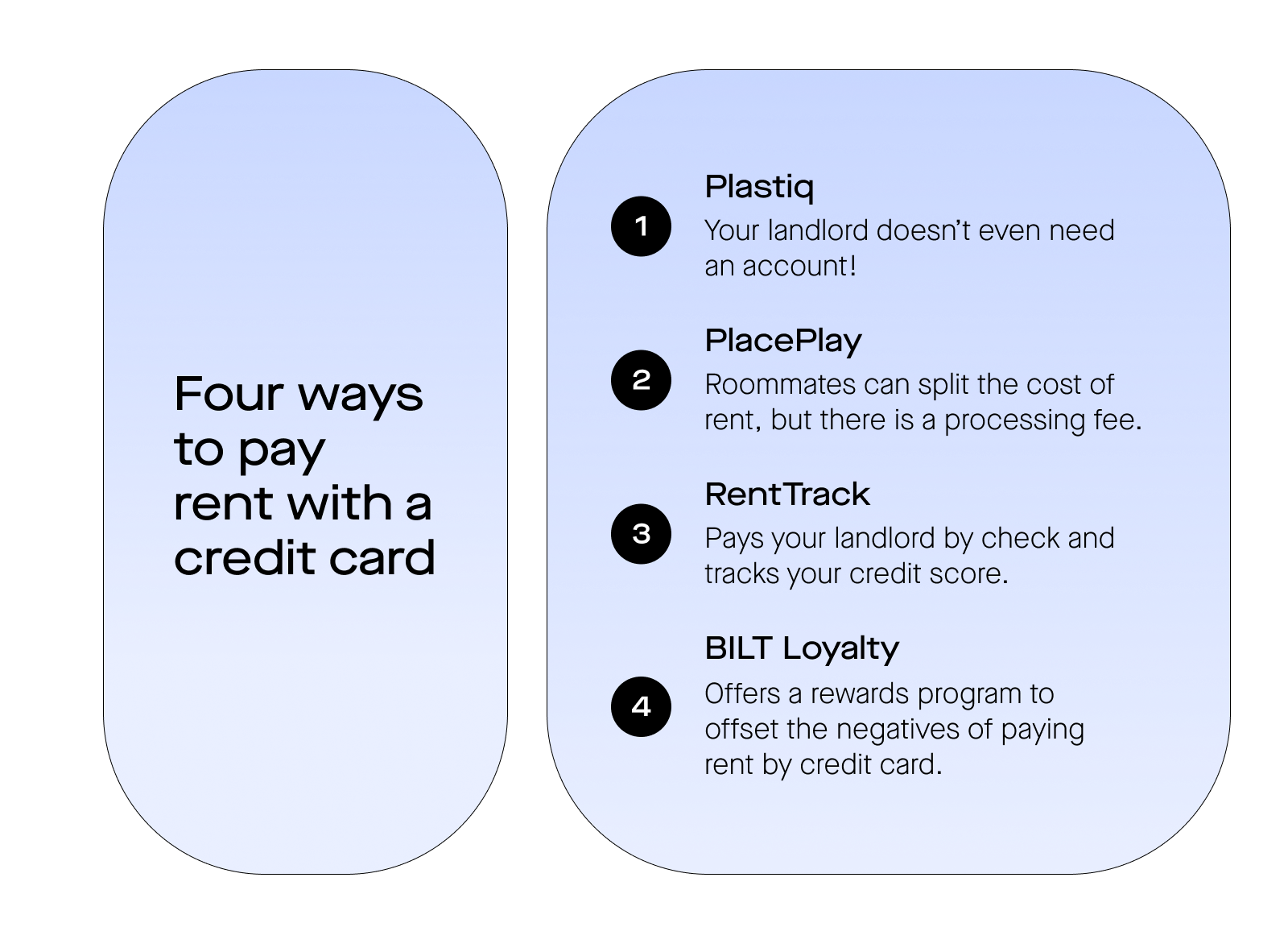

How to pay rent with a credit card

Sometimes a landlord or property manager might accept rent payments through Paypal or Venmo, however if they don’t have a payment service that readily accepts credit or debit cards, there are several platforms that give you the ability to pay your landlord with a credit card directly.

Plastiq: Offers you the chance to pay your landlord with a credit card without your landlord needing an account. Plastiq will send them a check or an electronic payment.

PlacePay: This program does require landlords to have an account and also charges a processing fee of $2.99%. However, here, roommates can split the cost of rent and choose their payment method. There’s also a mobile app for both iPhones and Androids.

RentTrack: Pays your landlord directly with a paper check and charges a processing fee dependent on the payment method. This service also works with you to keep track of your credit score and financial portfolio.

BILT Loyalty - BILT is one of the best credit cards offering a rewards program to participants for handling their monthly rent payment. Maximize your rewards and avoid late fees by allowing BILT Loyalty to make sure rent is always paid on time.

As you can see there are many third-party services out there making it easier than ever to leverage your available credit to suit your financial situation, some may even offer a sign-up bonus.

Things to consider before paying rent with a credit card

Paying your rent with a credit card can indeed be the best option for you at a time when things are stressful and unsure. Before proceeding, take a moment to make sure you’ve considered all of your other available options:

Talk to your landlord

This can be one of the most intimidating ideas, but often landlords and management companies are willing to work out payment plans and accommodations, especially for awesome renters. And if a landlord does file a claim against a Rhino renter’s policy for unpaid rent, Rhino is here to help.

Ask family or friends

No one loves to ask for help but asking our close friends and loved ones can be an effective way to avoid extra fees and payments that could continue to hold you back financially.

Unemployment or other assistance programs

Looking into your local, state, and federal assistance programs can yield surprisingly helpful resources. There are aid programs that are meant to be used so don’t be afraid to search for assistance.

As the national code for community resources, this number is a direct link to help.

Sublet or Get a Roommate

Another person chipping in money for rent can help ease a huge burden, or list a room on a short-term vacation rental site to earn additional income.

You probably don’t need to be reminded of the consequences of not paying your rent. For over a year now there’s been a moratorium on evictions in the United States due to COVID, however the CDC has announced that the latest extension, ending July 31, 2021, will be the final extension of protections for renters facing eviction.

Making changes to your personal finances to avoid this situation will be best for you in the long run. However, right now, you need to solve the problem at hand: Paying your rent at the end of the month. And using your available credit might just be the best solution.